In this Binance review, we’ll delve into the features and services of the leading cryptocurrency exchange, which has been making waves in the industry since its inception in 2017 by Changpeng Zhao (CZ), and now serves millions of users globally.

What is Binance?

Binance is a prominent cryptocurrency exchange that operates as a centralized platform. Users can trade a diverse array of digital assets, including Bitcoin, Ethereum, and Binance Coin (BNB), its native token. The platform facilitates buying, selling, and trading crypto with other users, offering a wide range of trading options, including spot, derivatives, and margin trading.

Binance’s History and Growth

Binance, founded in 2017, quickly rose to become a leading crypto exchange. Its initial success was fueled by a successful Initial Coin Offering (ICO), raising $15 million in funding. Binance’s rapid growth was driven by its user-friendly interface, low trading fees, and extensive selection of coins. Today, it boasts a global user base and a vast ecosystem of services, solidifying its position as a dominant force in the crypto space.

Features and Services

As part of this Binance review, we’ll delve into the features and services of the Binance exchange, which offers a comprehensive suite of trading and investment services, catering to both novice and experienced users.

Spot Trading

Binance’s spot trading platform allows users to buy and sell crypto at the current market price. It offers a wide range of trading pairs, including Bitcoin, Ethereum, USDC, Solana, Pepe, Shiba Inu, BNB, Dogecoin, XRP, Sui, USDT, ASI Alliance (FET), Akash and many other altcoins. The platform features a user-friendly interface, with customizable charts and order types for advanced trading strategies. Spot trading is a fundamental feature of Binance exchange, enabling users to directly purchase and sell digital assets.

Derivatives Trading

Binance offers a robust derivatives trading platform, allowing users to speculate on the price movements of cryptocurrencies. This includes futures contracts, where traders can enter into agreements to buy or sell an asset at a predetermined price and date. Binance Futures provides leverage, enabling traders to amplify their potential profits or losses. The platform also offers options contracts, providing users with the right, but not the obligation, to buy or sell an asset at a specific price.

Trading Bots

Binance exchange provides users with access to a range of automated trading strategies through its Trading Bots feature. This includes a variety of pre-built bots, such as Spot Grid, Futures Grid, Rebalancing Bot, Spot DCA, and Auto-Invest.

These bots can be used to automate trading strategies, including buying and selling at preset intervals, rebalancing portfolios, and implementing dollar-cost averaging investment strategies. Users can also access a Bot Marketplace to explore and filter trading bot strategies, as well as educational resources from the Strategy Academy to help them get started.

Copy Trading

Binance’s Copy Trading feature allows users to automatically copy the trades of experienced traders in real-time, providing a unique opportunity for novice traders to learn from the best. By following lead traders, users can gain valuable insights into successful trading strategies and techniques, and potentially earn profits from their investments.

Lead traders, on the other hand, can profit from their followers’ successful trades. However, as with any investment, there are risks associated with copy trading, including the potential for losses and slippage during volatile markets. It’s essential for users to exercise caution and invest rationally within their financial means.

P2P Trading

Binance’s Peer-to-Peer (P2P) trading platform allows users to buy and sell cryptocurrencies directly with other users, without the need for intermediaries. This platform provides a secure and convenient way for users to trade cryptocurrencies, with features such as escrow services and secure payment methods. Binance P2P trading supports multiple payment methods, including bank transfers, credit cards, and online payment services.

NFTs

Binance exchange has embraced the non-fungible token (NFT) market, offering a platform for users to buy, sell, and trade digital collectibles. Binance NFT Marketplace features a diverse range of NFTs, including artwork, music, and gaming items. Users can create their own NFTs, explore collections, and participate in auctions. The platform aims to provide a secure and user-friendly environment for NFT transactions, contributing to the NFT ecosystem.

Passive Earning Options

Binance offers various passive earning opportunities for users to generate income from their cryptocurrency holdings. Users can stake their crypto assets, earning rewards by contributing to the security and operation of blockchain networks. Binance exchange also provides lending services, allowing users to lend their cryptocurrencies to borrowers and earn interest. These passive earning options provide additional avenues for users to maximize the potential of their digital assets.

Security Measures

Binance prioritizes security, employing robust measures to protect user funds and data. The platform implements multi-factor authentication (2FA), proof-of-reserves, and a Secure Asset Fund for Users (SAFU) to ensure user funds are safe and secure.

Two-Factor Authentication (2FA)

Binance exchange strongly encourages users to enable two-factor authentication (2FA) for an extra layer of security. This adds an additional step to the login process, requiring users to enter a unique code generated by a mobile app or email in addition to their password. By requiring this extra verification, 2FA significantly reduces the risk of unauthorized access to user accounts, enhancing the platform’s security measures.

Proof-of-Reserves

Binance implements a proof-of-reserves system to demonstrate that it holds sufficient cryptocurrency assets to cover user balances. This transparency measure involves regular audits to verify the platform’s holdings and ensure that user funds are fully backed. By providing evidence of its reserves, Binance aims to build trust and confidence among its users, reinforcing its commitment to financial security and accountability.

SAFU (Secure Asset Fund for Users)

Binance exchange has established a Secure Asset Fund for Users (SAFU), a dedicated fund designed to protect user assets in the event of unforeseen circumstances, such as security breaches or hacks. This fund is funded by a portion of Binance’s trading fees, demonstrating its commitment to user security. The SAFU provides an extra layer of protection for users, offering peace of mind and reassurance that their funds are secure even in the face of unexpected events.

Cold Storage

Binance utilizes cold storage to protect a significant portion of its users’ crypto assets. Cold storage involves storing digital assets offline, on devices that are not connected to the internet, making them inaccessible to hackers. This offline storage method significantly reduces the risk of theft and unauthorized access, ensuring the safety of users’ funds.

Security Audits

Binance regularly undergoes independent security audits by reputable third-party firms. These audits assess the platform’s security protocols, code, and infrastructure to identify vulnerabilities and ensure best practices are implemented. The results of these audits are often made public, providing transparency to users about the security measures in place. Security audits enhance the platform’s resilience against potential threats and bolster user confidence.

Fees

Binance exchange charges fees for trading and withdrawing cryptocurrencies.

Trading Fees

Binance employs a maker-taker fee structure for spot trading. Makers, who add liquidity to the market by placing limit orders, generally pay lower fees than takers, who remove liquidity by placing market orders. The fees are tiered, with lower rates for users who trade larger volumes. Binance also offers discounts for users who choose to pay fees with Binance Coin (BNB), its native token.

Withdrawal Fees

Binance charges withdrawal fees for transferring cryptocurrencies from the exchange to external wallets. The fees vary depending on the cryptocurrency being withdrawn. The fees are typically based on the network costs associated with processing the transaction. Binance exchange aims to keep withdrawal fees competitive, ensuring users can efficiently manage their crypto assets.

User Interface

Binance offers a user-friendly interface, accessible via web browser and mobile app.

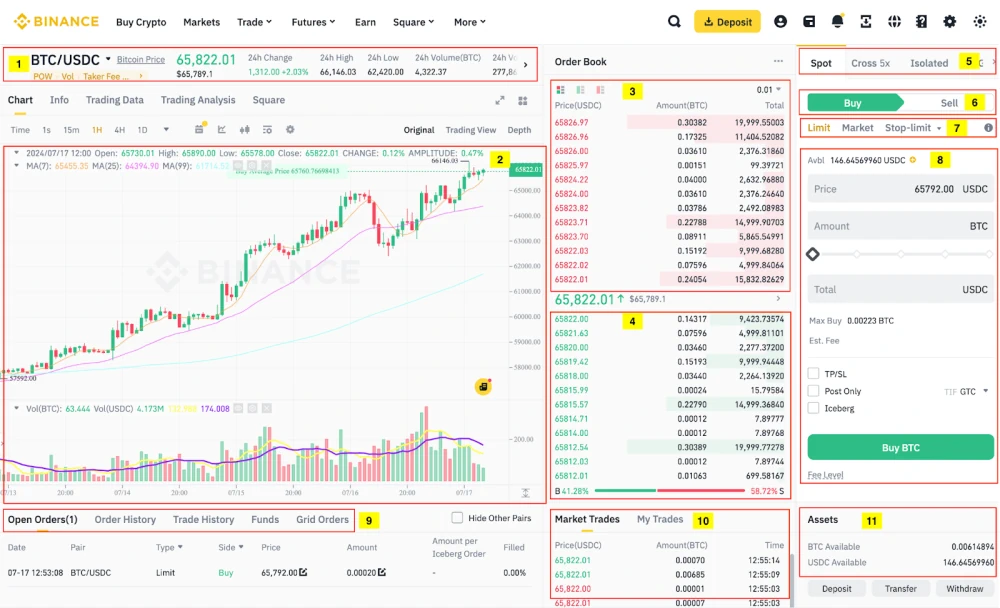

Web Interface

Binance’s web interface is designed for intuitive navigation and comprehensive trading functionality. Users can access various features, including spot trading, derivatives trading, and NFT marketplace.

The interface provides real-time market data, customizable charts, and order types for advanced trading strategies. Users can manage their accounts, deposit and withdraw funds, and monitor their portfolio performance from the web interface.

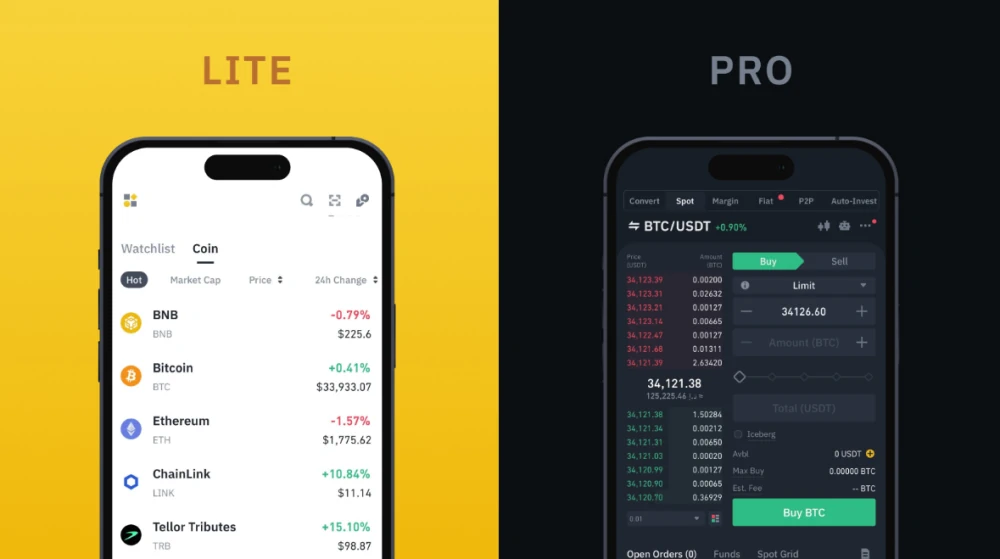

Mobile App

The Binance mobile app offers two distinct trading modes: Binance Lite and Professional (Pro). These modes cater to different user needs and provide varying levels of functionality. Binance Lite is designed for straightforward trading, while the Professional mode offers more advanced features and tools for experienced traders. Binance offers a dedicated mobile app for both Android and iOS devices, allowing users to access its services on the go.

The app provides a streamlined experience for trading, managing accounts, and accessing key information. Users can monitor market trends, place orders, and manage their portfolio through the app. The mobile app enhances convenience and accessibility, enabling users to engage with Binance anytime and anywhere.

Regulatory Compliance

Binance exchange actively seeks to comply with regulatory frameworks in various jurisdictions.

Licensing and Registration

In this part of our Binance review, we’ll explore the regulatory compliance efforts of Binance exchange, which has obtained licenses and registrations in multiple jurisdictions. The exchange actively seeks to comply with local regulations, adapting its operations to meet specific requirements. These licenses and registrations provide a framework for Binance to operate within legal boundaries and foster trust among users and regulators.

Compliance Initiatives

Binance has implemented various compliance initiatives to enhance its regulatory posture. These include robust Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures, designed to verify user identities and prevent financial crimes. The exchange also collaborates with regulatory bodies and industry partners to promote responsible cryptocurrency practices. These efforts aim to ensure a safe and compliant environment for users while building trust within the broader financial ecosystem.

Supported Coins

This Binance review will examine the extensive selection of cryptocurrencies supported by Binance exchange, which exceeds 350 digital assets. This extensive selection provides users with a wide range of trading opportunities, encompassing major cryptocurrencies like Bitcoin and Ethereum, as well as Stablecoins, Meme Coins, AI coins, Layer 1s, Layer 2s, DePIN, DeSci, and other kinds of altcoins. The platform’s commitment to listing a diverse array of cryptocurrencies contributes to its reputation as a leading exchange in the industry.

Ecosystem

The Binance exchange has developed a thriving ecosystem of services and products, as highlighted in this comprehensive Binance review.

Binance Coin (BNB)

Binance Coin (BNB) is the native token of the Binance ecosystem. It serves various purposes, including discounted trading fees on the Binance exchange, payments for services within the Binance ecosystem, and staking for rewards. BNB has gained significant traction, becoming one of the top cryptocurrencies by market capitalization. Its utility and value proposition within the Binance ecosystem have contributed to its widespread adoption and growth.

Binance Smart Chain (BSC)

Binance Smart Chain (BSC) is a blockchain network that runs in parallel with Binance Chain. It offers a platform for developers to build and deploy decentralized applications (dApps) and smart contracts. BSC is compatible with the Ethereum Virtual Machine (EVM), enabling developers to easily port existing Ethereum dApps. The network features low transaction fees and faster confirmation times, making it an attractive alternative to Ethereum for dApp development.

Customer Support

Binance provides customer support channels to assist users.

Support Channels

Binance offers various customer support channels to assist users with inquiries and issues. Users can access support through live chat, email, and a comprehensive help center with FAQs and articles. The exchange also maintains a presence on social media platforms, providing additional avenues for communication and community engagement. These support channels aim to provide users with prompt and efficient assistance.

Response Time

Binance aims to provide prompt customer support, with response times varying depending on the channel and complexity of the issue. Live chat generally offers the fastest response, while email inquiries may take longer to be addressed. The exchange strives to provide timely and effective solutions to user inquiries, fostering a positive customer experience. However, response times can fluctuate based on the volume of inquiries and the nature of the issue.

Comparison with Other Exchanges

Binance stands out as a major player in the cryptocurrency exchange market.

Binance vs. Coinbase

Binance and Coinbase are both major cryptocurrency exchanges, but they cater to different user needs. Binance is known for its extensive trading options, deep liquidity, and lower fees, appealing to experienced traders and those seeking a wider selection of cryptocurrencies. Coinbase, on the other hand, focuses on user-friendliness and ease of use, making it a popular choice for beginners. While Binance offers a broader range of advanced features, Coinbase prioritizes simplicity and a more regulated environment.

Binance vs. Kraken

Binance and Kraken are both established cryptocurrency exchanges, each with its strengths. Binance is known for its high trading volume, extensive cryptocurrency selection, and robust derivatives platform. Kraken, on the other hand, emphasizes security, regulatory compliance, and institutional-grade features, attracting a more sophisticated user base. While Binance offers a wider range of trading options, Kraken prioritizes security and regulatory adherence, making it a preferred choice for those seeking a more robust and secure platform.

Final Thoughts

In conclusion, Binance exchange is a premier destination for cryptocurrency trading, offering a wide range of features, tools, and services that cater to users of all levels. With its extensive selection of cryptocurrencies, robust derivatives platform, and innovative features like Trading Bots and Copy Trading, Binance has solidified its position as a leading player in the industry. Its commitment to security, regulatory compliance, and customer support further enhance the user experience.

Whether you’re a seasoned trader or just starting out, Binance has something to offer. So why wait? Register now and discover the benefits of trading on Binance for yourself. With its user-friendly interface, competitive fees, and extensive features, Binance is the perfect platform for anyone looking to trade cryptocurrencies with confidence. Join the millions of users who have already made Binance their go-to exchange and start trading today!